Tipping points in sight for the industry transition.

Tipping points are emerging for heavy industry sectors that were previously thought of as ‘too hard to abate’. Demand side policies can turn this into a domino effect that leads to the systemic change required to deliver radical emission reductions, green jobs, and build back better.

Tipping points tend to be bad news. In climate science, this is the point at which a small change can alter an entire system. The Amazon rainforest, the Greenland ice sheet, the carbon-rich soils of the permafrost: just three of the Earth systems that can change abruptly – and permanently – because of global warming.

But when it comes to the systems change required to decarbonise industry, there are signs that we are reaching technological and financial tipping points that are good news for the climate.

Pushed by public finance, some sectors are almost there

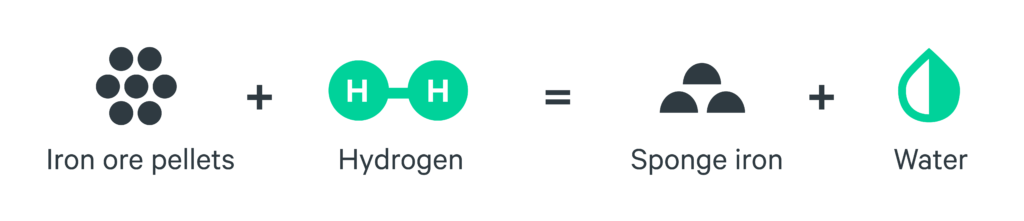

Closest to the edge is steel. Zero-carbon steel, produced with hydrogen from renewable electricity, is moving very rapidly from pilot to demonstration phase.

In Sweden’s HYBRIT project, 1.3 million tonnes of fossil-free sponge iron (the key ingredient for zero-carbon steel) will be produced by 2026, and full-scale production will start in 2030. Two other European steel companies, ThyssenKrupp and Salzgitter AG, are also on track to produce significant quantities of very low-carbon steel using similar processes.

On a similar trajectory is the heavy trucking sector, which will begin rolling out electric trucks in this decade. This commercial decision is backed up by recent research showing that battery electric heavy trucks could soon be more competitive than diesel trucks, if fast charging infrastructure is put in place.

Other sectors, for example cement and concrete, have further to go before reaching systemic tipping points. But they are accelerating. There are readily implementable options available to reduce emissions. These include using alternative fuels such as waste and biomass for part of the process, and reducing the amount of clinker used, replacing it with supplementary cement materials such as calcined clay. This clinker substitution can on its own bring down emissions by 40%.

Technological innovation is only one tipping point factor. Finance is another. In recent years governments have provided financial support for the research and development of new technologies and helped ambitious industry projects go from drawing board to pilot and demonstration plants. This initial support to stimulate the production of very low carbon materials will need to continue, especially for the most novel technologies and for the very largest investments.

Policies for acceleration

Supply side policies provide a good shove towards systems level tipping points. But to create a domino effect, policymakers will need to act on the demand side too. As very low-carbon technologies reach pilot stage and demonstration scale, it is critical to put in place the frameworks to build confidence in and create demand for these ‘net zero’ products. To build confidence, governments must play an important role in developing and championing product standards that are comparable across jurisdictions. To catalyse demand, governments should set procurement targets so that public infrastructure truly builds back better.

From experience in other transitions, ensuring initial demand/offtake (both in volume and with a timetable for decreasing emissions) can act as a tipping point for the whole sector. A strong demand signal reduces (or at least begins to quantify) financial risk and enables companies and financial markets to make significant capital investments and embrace new business models.

Public demand for low carbon industry products in turn has the potential of activating whole value chains. Some of the heavy industries are purchasers of other industry products – for example, the heavy truck manufacturer Volvo has recently committed to purchasing zero-carbon steel to produce their vehicles. The construction industry uses large quantities of steel and concrete, for the built environment and for the wind turbines, solar parks and electricity grids needed to bring about the energy transition. Demand side policy and action can open up a giant value chain opportunity across sectors, and across borders.

US focus on industry transition adds momentum

Transitioning industry will have to be an important element in the US administration’s climate policies: More than one third of US greenhouse gas emissions in 2018 came from industrial production and industrial emissions associated with all goods and services consumed in the US, including imports.

Already, the administration is sending clear signals it has understood the potential of transitioning industry. One such signal comes from recent US climate diplomacy. The joint US-China statement stated that “policies, measures, and technologies to decarbonize industry and power” would be among the concrete actions both nations would continue to discuss among the “concrete actions in the 2020s to reduce emissions.”

The US joining the Leadership Group for Industry Transition (LeadIT), is another clear signal that adds to the political momentum for decarbonization. The US is among the largest producers of chemicals, the third largest producer of cement, the fourth largest producer of steel, and the ninth largest producer of aluminum. But it’s not only the size of the market, it’s also the US’ track record in innovation and financial muscle that will push the industry transition closer to the edge.

Tipping towards a fairer future?

But let’s not forget that the transformative potential of the industry transition extends far beyond sectors and policy, technology and finance. After all, US President Joe Biden called his recently presented infrastructure plan to rebuild bridges, renew the electric grid and retrofit buildings the “American Jobs Plan.” The industry transition offers an opportunity to create jobs and other societal benefits the value of which may eclipse that which can be measured in emissions reductions or technology implementation alone.

While systemic tipping points appear to be within reach for industrialized countries, the next big frontier for industry transition is addressing the question of how to ensure developing and middle-income countries can implement low-carbon technologies and take advantage of new markets for zero-carbon products. They will need finance (or, at least, a lower cost of capital), know-how, and access to technology.

Enabling developing countries to achieve the industry transition is key. Just as the politicians of advanced economies are realising that the industry transition will fail without a just transition for workers, so must they also grasp that the Paris Agreement targets can only be reached if all sectors in all economies decarbonise. The industry transition cannot exacerbate inequalities between countries. In that sense, the industry transition can and should work towards yet another systemic tipping point – a societal tipping point towards a more equitable world.

Authors: Robert Watt, LeadIT Secretariat, and Anthony Hobley, Mission Possible Platform & World Economic Forum

On Thursday 27 May, the World Economic Forum in collaboration with the COP 26 Presidency, The Marrakech High level Champions and the Mission Possible Partnership will host a Climate Breakthroughs: The Road to COP26 summit to examine the systemic tipping points required to deliver real net zero breakthroughs with a focus on the steel, maritime, and hydrogen. Stay tuned for more.