Steel and cement can drive the decade of action on climate change. This is how.

Originally published on 17 May 2022 by UNIDO’s Industrial Analytics Platform (IAP), a digital knowledge hub that combines expert analysis, data visualizations and story telling on topics of relevance to industrial development. The views expressed in this column are those of the authors and do not necessarily reflect the views of UNIDO or other organizations that the authors are affiliated with.

COP26 commitments must now be turned into concrete actions – a complex but urgent task.

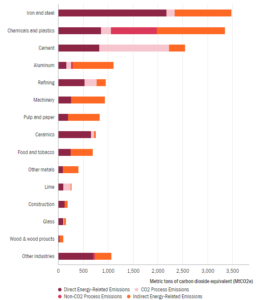

Steel and cement are an integral part of the modern world. Steel is found in everything, from major infrastructure to kitchenware, while cement, as the principal ingredient in concrete, is the most widely consumed resource in the world after water. Approximately 3 metric tonnes of cement are used annually for every person in the world.1 Steelmaking and cement production are both highly emission intensive. The need for continuous high-temperature heat to produce steel, cement and concrete requires huge amounts of energy, much of which is still dependent on fossil fuels. Moreover, the chemical processes involved in producing these materials are themselves a major source of emissions. By most estimates, steel and cement production account for just over 50 per cent of all industrial emissions (see figure below).

Global greenhouse gas emissions by industry (2014)

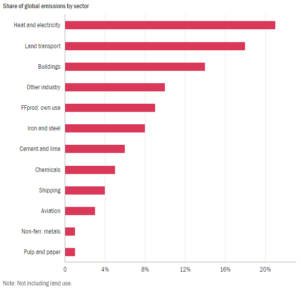

Nearly 2 billion tonnes of steel are produced every year, generating around 8 per cent of all global CO2 emissions. For each tonne of steel produced in conventional furnaces, between 1.5 tonnes and 3 tonnes of CO2 are released into the atmosphere. Cement accounts for a further 6 per cent of total emissions, with two-thirds related to the chemical reactions involved in production, and the remaining one-third resulting from fuel combustion.

Share of global direct combustion and process CO2 emissions (2016)

Source: Bataille, C., (2019).

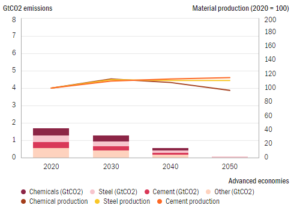

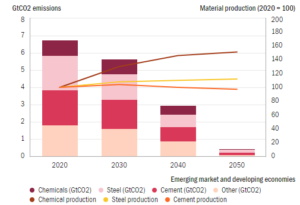

Moreover, demand for cement and concrete is set to increase by more than one-third by 2050, when the global population is expected to reach 9.7 billion, 70 per cent of which will be living in cities.2,3 To accommodate this massive urban expansion, an equivalent of another New York City will be built every month for the next 40 years. Even technologies that are driving the energy transition, such as wind turbines, require large amounts of steel and concrete. It is therefore imperative for the mining and manufacturing industries—and especially steel and concrete—to bring their process technologies in line with climate commitments. To achieve this, process emissions in the steel industry must fall by at least 30 per cent by 2030.4 Reaching net-zero emissions from cement by 2050 will require the industry to address technical limitations and establish the use of carbon capture and storage (CCS) technologies.5 As shown in the chart below, the challenge will be far greater for developing economies.

Even technologies driving the energy transition, such as wind turbines, require large amounts of steel and concrete.

Global emissions from steel and cement production will have to decrease by more than 90% by 2050

Source: Maltais, A., Gardner, T., Godar, J., Lazarus, M., Mete, G., and Olsson, O. (2021).

The challenges ahead

Deep decarbonization of the steel and cement industries will require several parallel strategies: demand management using market creation and circular economy principles, improvements in energy efficiency through technical advancements, and major shifts in production methods and technology. Although some of these technological and process innovations are commercially viable or already in pilot stages, there are currently no commercial-scale sites producing (near) zero-emission steel or cement. Moving this forward will require some incremental process innovations (such as energy efficiency solutions) as well as some more radical ones. Furthermore, heavy industry is associated with high capital intensity, meaning the development of new plants requires investments of several billions of US dollars, while incremental improvements require investments in the order of hundreds of millions of US dollars. It is estimated that the development, commercialization and deployment of such innovations could cost USD 26 – USD 60 per tonne of CO2 for steel, and USD 110 – USD 130 per tonne for cement.6

The long investment cycles that typify these production facilities represent another challenge – steel and cement plants generally have a lifespan of around 40 years, and investment cycles of 25 years. Windows of opportunity open only rarely, and retiring assets before the end of their productive life goes against the grain of traditional business and economic doctrine. This is even more salient in emerging economies as their global fleet of heavy industry assets is typically relatively young. Additionally, the global market’s competitiveness for cement and steel and the consequently slim profit margins, make experimentation with unproven technologies unattractive. Either way, any capital investments in cement and steel are likely to “lock in” the industry’s emissions profile for several decades to come. Significant policy support will therefore be fundamental for de-risking this type of investment.

Heavy industry is associated with high capital intensity and long investment cycles.

New frontiers

While industrial decarbonization may seem daunting, it also represents an exciting industrial frontier, with many advances already underway. The use of electric arc furnaces and renewably produced hydrogen are already reducing energy and resource consumption, with additional benefits higher up the supply chain. In 2021, Swedish steel manufacturer Hybrit provided Volvo with steel that had been produced using the hydrogen production process.

Other ventures are inspired by the circular economy, leveraging innovations in recycling and primary resource reduction. While a lot still needs to be done, there is, in principle, no reason for steel to not be a fully recyclable product. Initiatives and R&D in this field are taking place worldwide, such as technology invented in Australia that harvests carbon and other useful materials from old rubber tyres to replace coke and coal in steelmaking. Similarly, technologies that optimize the construction process and reduce waste, such as 3-D printing, have emerged. Deep decarbonization is therefore primarily a question of scaling up, accessing finance and offering products at a competitive price.

Given the challenges discussed above, market creation is a crucial component in the quest for net-zero. A strong demand signal is needed to incentivize the effort, cost and perceived risk involved in bringing new technologies online. One of the most promising routes would be through a commitment to green public procurement in major municipalities and among importers of construction materials. Worldwide, government agencies are among the top buyers of steel, cement and concrete for major infrastructure projects, and leveraging their immense purchasing power would trigger a thriving market for greener steel and concrete.

The Industrial Deep Decarbonization Initiative (IDDI) proposes to do just that. Launched at COP26 in Glasgow, it is an initiative of the United Nations Industrial Development Organization (UNIDO) in partnership with the United Kingdom, India, Germany, the United Arab Emirates and Canada. It sets a challenge for industry: if you produce low-carbon steel and concrete, we’ll buy it. This guaranteed market sends a strong signal to producers since, together, the participating governments represent between 25 per cent to 40 per cent of domestic markets for heavy construction materials.

The IDDI has set a challenge for industry: if you make low-carbon steel and concrete, we'll buy it.

More needs to be done, however

Of course, numerous challenges remain. Among the biggest obstacles to the decarbonization of industrial sectors is the lack of data and standards. Current systems do not capture all that is required to accurately evaluate embodied carbon along the supply chain. Advances in producing accurate, high-resolution data are urgently needed; establishing standardized, comprehensive calculation methods that are comparable across producers and jurisdictions; and developing procedures and knowledge to apply and report on environmental requirements.

A second consideration is that the bulk of demand for construction materials over the next few decades will come from developing countries. While many of these countries possess a wealth of the renewable resources needed in this transition, they risk being left behind in premium green commodity markets. A mismatch in the spatial distribution of supply and demand could seriously undermine the decarbonization of these industries.

A way forward

Nevertheless, there is now a realistic way forward and, what is more, the transition is affordable. Although substantial investment is required, it is important to put this into perspective: the Energy Transitions Commission (ETC) has shown that net-zero carbon emissions from heavy industry could cost less than 0.5 per cent of global GDP.7 With investors, industry leaders and influential markets all pulling in the same direction to break down the common policy, technology and financing barriers, industrial decarbonization may be just over the horizon.

Net-zero carbon emissions from heavy industry could cost less than 0.5 per cent of global GDP.

References

- Gagg, C.. (2014). Cement and Concrete as an engineering material: an historic appraisal and case study analysis. Engineering Failure Analysis. 40. 10.1016/j.engfailanal.2014.02.004.

- IEA (2020) Iron and steel technology roadmap.

- GCCA (2020) Climate Ambition.

- IEA (2021) Net Zero by 2050.

- IEA (2021) A roadmap for the global energy sector.

- Energy Transitions Commission (2018). Mission Possible – Reaching Net-Zero Carbon Emissions from Harder-to-Abate Sectors by Mid-Century.

- https://www.energy-transitions.org/publications/mission-possible/