Accelerating industry transition in developing countries: a comparative analysis.

Photo: ferrantrite / Getty

Key messages

- Decarbonization efforts for industrial sectors are still largely focused in developed countries. There is far less understanding of the key barriers and challenges to bringing about industry transitions in developing countries, where industrial emissions are increasing.

- Our analysis of Indonesia, Mexico and South Africa shows that all three do have some decarbonization measures for industry in place, but these vary in effectiveness. While Indonesia’s policy framework for industry is lacking, Mexico’s is much more rigorous, with industry-specific targets and pathways, though its implementation has been delayed. South Africa, on the other hand, has decarbonization plans in place that largely lack ambition.

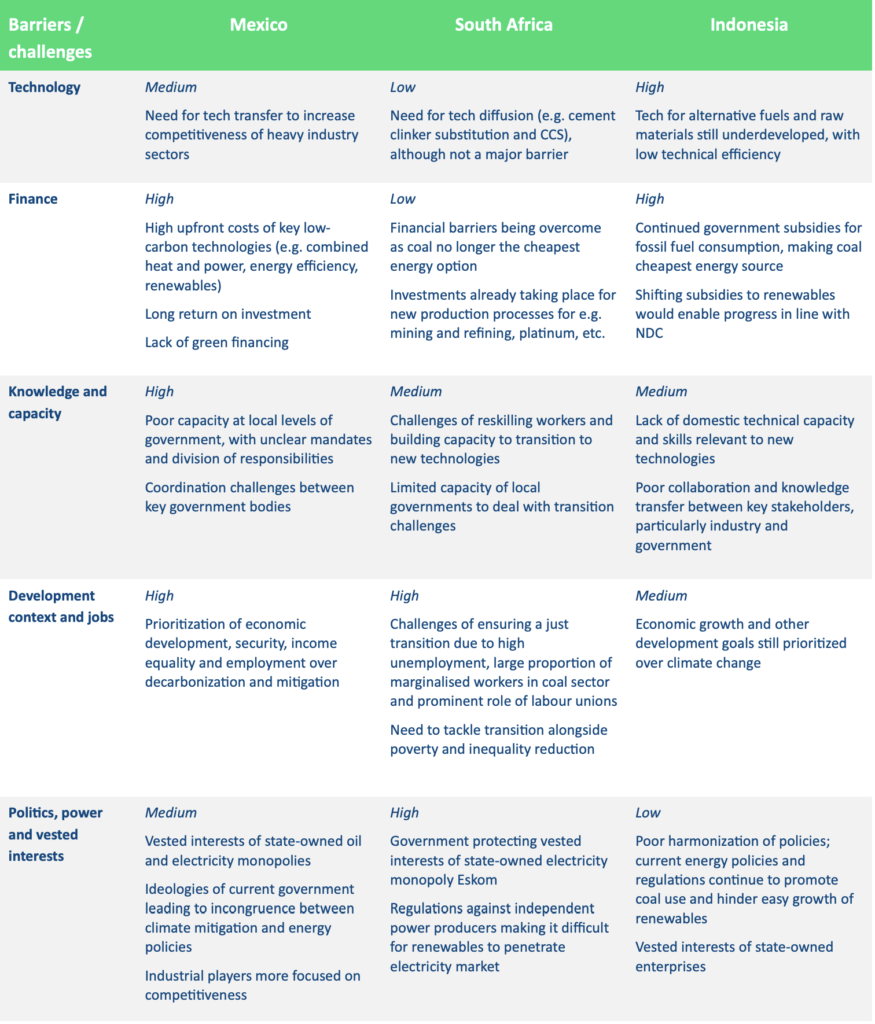

- Five main types of barrier to industry transition exist in all three countries: technology; finance; knowledge and capacity; socio-economic context and jobs; and politics, power and vested interests. Barriers are primarily techno-economic in Indonesia, socio-economic in Mexico and socio-political in South Africa.

- In addition to essential forms of support from the international community such as technology transfer, climate finance and capacity building, other important social and political challenges also need to be acknowledged and tackled to make progress on industry transition.

Download

Read the brief (pdf)Introduction

Industrial sectors such as steel, cement and concrete account for roughly 30% of global CO2 emissions, making industry decarbonization fundamental to complying with Paris Agreement targets. To date, however, efforts towards decarbonizing industries are predominantly concentrated in developed countries, despite significant carbon-intensive industries also existing in developing countries. Moreover, the majority of industrial emissions over the coming decades are likely to come from developing countries, as they satisfy demands for cement, steel and petrochemicals. This raises the question of how industry transitions in developing countries can be fostered to enable decarbonization in line with their commitments made under the Paris Agreement.

To address these concerns, this brief presents initial insights from an analysis of the industry transition potential in developing countries, synthesizing the barriers and challenges they face when implementing industry transition measures. We focus here on three middle-income developing country case studies: Indonesia, Mexico and South Africa. These were selected as they are all top producers in heavy industry amongst developing countries, as illustrated in Figure 1.

Our analysis is based on a review of policies and documents related to climate change and industry decarbonization, and interviews with stakeholders from national government, key industry players, civil society and the private sector.

Current status of industry transition in case study countries

In general, all three countries have in place policies and measures aimed at industry decarbonization, but with varying degrees of effectiveness in terms of actual implementation and decarbonization. Although the industry transition and energy transition are very closely linked in all three countries, a strong climate policy framework in Indonesia is particularly lacking compared to the other two countries.

However, South Africa’s framework has also been criticized for not being ambitious enough and for promoting continued coal-powered electricity generation. Mexico’s policy framework appears to be the strongest of the three, including both an industry-specific carbon reduction target as well as pathways for how the target can be reached through specific mitigation measures in key industry hotspots. However, stakeholders question commitment to implementing the target at a federal level.

Indonesia

Industrial emissions make up a third of all CO2 emissions in Indonesia, with top emitting sectors including iron and steel, cement, and chemicals. As the country is the one of the world’s largest coal exporters and the largest energy user in Southeast Asia, the industry transition in Indonesia is very closely tied to the energy transition. Electricity production is largely dependent on fossil fuels and non-renewable energy resources like oil, gas and coal, making up about 75% of final energy consumption. Therefore a reduction in coal and oil consumption, coupled with an increase in renewables, is crucial to industry transition in Indonesia. To this effect, the country’s nationally determined contribution (NDC) under the Paris Agreeement includes a commitment to increase the share of “new and renewable” energy in primary energy from 23% in 2025 to 31% by 2050. However, according to an energy transition roadmap developed by the International Renewable Energy Agency (IRENA), Indonesia has the capacity to achieve its 2050 renewable energy goal by 2030.

Despite this, insights from interviews indicate that policies and measures on industry transition in the country are very limited. Industrial transitions occur mostly in the Indonesian subsidiaries of international companies because of market competition and without government intervention. Meanwhile, progress on implementation is delayed by conflicting policy interventions, like coal subsidies, and poor interaction between government and industry. Decarbonization is still a low priority in Indonesia, and policies have been criticized for being too general and not ambitious enough. Furthermore, there still seems to be a lack of industry-specific regulations linked to developing new technologies for high emitting sectors.

Mexico

Industrial processes in Mexico contribute 17% of national carbon emissions, primarily due to fossil fuel consumption for manufacturing in the iron, steel and cement industries. To address its emissions, Mexico has a well-established climate policy framework targeting these energy-intensive industries. Mexico’s NDC includes an unconditional sectoral emission reduction target for industry of 5% by 2030. This has been coupled with national plans for implementing Mexico’s NDC that detail the key mitigation measures needed to meet its targets. For instance, among other targets, this includes reducing the proportion of clinker used by the cement industry to 70% by 2050 and increasing the production of steel produced with electric arc furnaces to 80% by 2030. Mexico’s NDC target for industry is also supported by mitigation measures found throughout its climate policy framework. This includes measures on renewable energy, energy efficiency, fuel substitution, implementing carbon capture and storage, and reducing carbon emissions in industrial processes.

Despite playing the role of an international leader on climate action among developing countries, Mexico’s progress against its climate policy framework has been delayed and some researchers question its ability to achieve its mitigation targets. Stakeholders interviewed also questioned the pace of the climate policy framework’s implementation, noting that the government is focusing on other national priorities above industrial and energy transition. Nevertheless, some stakeholders recognized that progress had been made in some industries, for example, through increased use of scrap and electric arc furnaces in the iron and steel industry. However, this progress was attributed to firms being driven by cost reduction rather than federal strategies.

South Africa

South Africa’s industry sector plays an important role in the national economy, with industry and mining contributing to 24% of the country’s GDP and employing 2.2 million people. At the same time, the sector is responsible for 34% of South Africa’s energy consumption; with coal generating 92% of the country’s electricity, this ties the industry transition very closely to the energy transition. South Africa has a strong climate policy framework in place tackling both energy and industry decarbonization. For example, the South African Industrial Energy Efficiency (IEE) programme was developed to focus on optimizing energy systems in companies, with a post-2015 National Energy Efficiency Strategy (NEES) also currently under consideration, which proposes industrial sector targets that would reduce energy consumption in manufacturing by 16%The government also published a Draft Carbon Tax Bill in 2017, which includes two components: a carbon tax rate set at ZAR 120 per tonne of CO2 equivalent produced, and a carbon budget for sectors which, if exceeded, puts the tax into effect. More recently, the government approved an Integrated Resource Plan in October 2019, which aims to decommission over 35 GW of coal-fired power capacity by 2050 and promote a shift toward renewables.

Despite the presence of this strong policy framework, South Africa’s decarbonization strategy has been criticized for not being ambitious enough and for allowing continued expansion of coal-powered electricity generation. For example, several interviewees noted that the carbon tax was not high enough to incentivize investments in decarbonization. Furthermore, South Africa’s draft Mining and Energy Recovery Plan, published in the context of COVID-19, was criticized for allowing direct investments in high-carbon sectors such as gas, coalfields and mineral exploitation without imposing any “green” conditionalities. Within heavy industries such as iron and steel, the high reliance on coal has been flagged as making it impossible to achieve the 38% of reduction in energy consumption required to meet national climate targets.

Key challenges and barriers to industry transition

Our analysis revealed five key types of barrier to industry transition common to all three case study countries:

- technology

- finance

- knowledge and capacity

- development context and jobs

- power, politics and vested interests

Barriers to industry transition in Indonesia are primarily techno-economic, relating to critical gaps in technology and finance. In Mexico, barriers are more socio-economic, dominated by finance and capacity gaps as well as the country’s development priorities. South Africa appears to face more socio-political challenges, relating to politics, power and vested interests as well as the need for a just transition. However, all five challenges feature to some degree in each country, as summarized in Table 1.

Indonesia

In Indonesia, barriers to industry transition are primarily techno-economic – meaning that the main challenges in achieving transition are linked to gaps in technology and finance. There is a lack of cheap new technologies available, with coal still being the cheapest source for power generation. This is exacerbated by Indonesia’s high reliance on imported technologies, particularly for manufacturing. Almost 50% of petrochemicals and 74% of basic metals are imported, leading to higher production costs and increased emissions. Furthermore, existing technologies are still considered efficient and reliable, with no incentives in place for expanding to new technologies.

However, capacity gaps also play a role in hindering implementation of new technologies. For instance, a lack of knowledge of new energy efficient equipment among plant managers and maintenance staff has led to slow improvement of technical efficiency of industrial plants. Moreover, the technologies for using alternative fuels and raw materials are still underdeveloped because of a lack of trained manpower at all levels, a lack of knowledge of available options, and a lack of understanding of the economic viability of alternative options.

Although barriers relating to politics and the development context are less prominent in Indonesia, they still play a role in making the other barriers more difficult to overcome. For example, the government’s tendency to favour and subsidize coal-powered generation – particularly because the country is a global coal exporter – has disincentivized investment in renewables and other low-carbon technologies and made them less financially viable. There are also challenges relating to policy coordination, with interviewees pointing to a lack of harmonization between policies as well as poor dialogue between government actors and industry players.

Mexico

Mexico appears to face primarily socio-economic barriers to industry transition, with challenges dominated by finance and capacity gaps and the country’s development priorities. Several stakeholders highlighted that technology transfer is essential for transforming industry and increasing competitiveness of key sectors, particularly for cement and chemicals. This is exacerbated by barriers relating to finance. In Mexico, the cost of implementing decarbonization policies is a key challenge with, for example, investments in the range of US$13.2 billion required to transition the chemicals industry. Moreover, several studies emphasized the high upfront costs of low-carbon technologies such as renewable energy, energy efficiency and cogeneration of heat and power. For instance, return on investment time and financing are the main barriers to reducing energy demand and applying some energy efficiency measures, which can lead to conflict with the industry’s business model. Interviewees also pointed out a lack of green financing, with many national banks not investing in low-carbon technologies

Knowledge and capacity is another key barrier to industry transition in Mexico. While the country has a relatively well-developed institutional and legal framework to support climate policies, the level of capacity still varies between different sectors and levels of government. In particular, capacities at the local level are generally limited, which is a concern since part of the effort to comply with climate targets falls within municipal jurisdictions. Furthermore, key laws and policy documents do not clearly provide mandates or apportion responsibilities. As in the case of Indonesia, this has been coupled with poor coordination between key bodies and ministries, as well as weak accountability mechanisms.

Political barriers in Mexico make the key barriers described above more difficult to overcome. For example, interviewees highlighted that the existence of two state-owned energy monopolies, Pemex and CFE, reduces competitiveness and disincentivizes investment in renewable energy, with limited room for other companies to participate. The vested interests of different actors also play a role here. Stakeholders highlighted that the ideology and politics of the current government do not place energy transition as a priority, with more emphasis instead on self-sufficiency and energy security in terms of oil. This has led to subsidies for climate change mitigation projects being reduced: 1.1% of overall public expenditure is provided for mitigation, with 12% going to fossil fuels exploitation. Conflicting priorities is also an issue with key industry players, who are more focused on access to raw materials and energy supply to maintain competitiveness. Overall, despite having a strong policy framework in place, there appears to be a lack of political commitment and leadership, intensified through strong opposition from fossil fuel-intensive companies. More broadly, being a developing country means that Mexico feels compelled to place greater priority on economic development, security, income equality, and employment, with the current narrative not yet reconciling this with decarbonization.

South Africa

In South Africa, barriers to industry transition are more socio-political. Interviewees consistently emphasize that politics, power and vested interests play the primary role in hindering the country’s progress on industry transitions. Eskom, the state-owned electricity monopoly, generates almost all of the country’s electricity, and is 90% powered through coal-powered generation. In order to protect the interests of Eskom, the government has closed off the electricity market to Independent Power Producers (IPPs); ministerial approval is needed for anyone planning to generate their own electricity over 10MW. This is a key barrier for key industry players such as Sasol who are planning to decarbonize their supply chains through renewables, and is preventing renewables from penetrating the electricity market. More recently, however, this is shifting because Eskom is currently in significant debt and is looking to both restructure the company and allow other players to compete in energy generation, creating some potential for renewables.

These challenges are exacerbated even further through key priorities of unemployment and inequality. South Africa has one of the world’s highest unemployment rates, at 30%, which has only increased due to COVID-19. Job protection is therefore at the top of the government’s agenda, and significant power has been given to labour unions that have historically protested the closure of coal-fired power stations in the country. As such, the narrative of a just transition is particularly prominent in South Africa, including the creation of green jobs.

However, several interviewees highlighted that barriers relating to knowledge and capacity make a just transition more difficult. Jobs in coal mines are not directly transferable to jobs in the renewables sector, which would require significant reskilling. And currently, any agenda that may affect jobs is seen as a threat by workers. Financial barriers have also been increased because the country is in a dire economic situation due to COVID-19, with very little capital to invest in new technologies nationally, particularly without adequate international climate finance.

Although, despite these challenges, a majority of interviewees highlighted that barriers relating to finance, technology and capacity are in general much easier to overcome than those linked to politics, power and vested interests, particularly with international support. The biggest challenge in the country remains vested interests at all levels, with short-term profit motivations in the ruling party and business elite hindering progress, particularly because most value chains are very concentrated on three or four key players that control the entire market. This has also led to disproportionate distributions of power, with a serious lack of technology, finance and capacity for small-to-medium enterprises (SMEs).

Conclusions and recommendations

Overall, despite varying geographies and national contexts, all three countries studied face similar barriers and challenges when implementing industry transition measures. However, the prominence of these challenges differs in the different country contexts, with challenges falling being more techno-economic in Indonesia, socio-economic in Mexico and socio-political in South Africa.

Importantly, it is evident that more social and political challenges relating to development priorities, power dynamics and vested interests play a key role in hindering progress in all three countries, albeit to different levels. Therefore, conventional approaches to accelerating action in developing countries such as increased technology transfer, international climate finance and capacity building, whilst critical, may be insufficient to overcome all barriers and promote industry transition.

Based on this, several recommendations emerge from stakeholders interviewed on how these challenges can be mitigated, particularly how the international community and developed countries can provide this support:

- Reskilling of workers and training for the use of new technologies, including sharing best practice examples from similar contexts such as India where there may already be accelerated action.

- Global industry players and corporations applying the same standards and complying with the same environmental regulations in developing countries as they do in developed nations, including bringing their skills and technologies with them to the countries they are operating in. This is particularly necessary as border carbon taxes become more imminent and would put domestic industries in developing countries under threat.

- Co-financing national just transition funds through capital from both domestic banks and development finance institutions, which could be made conditional on implementing low-carbon measures. This would help tackle barriers relating to countries’ development context.

- Increased collaboration between developed and developing countries in developing new technologies such as green technology and CCS, including more knowledge-sharing, adapting technology for local contexts, and investment in research and development.

- Incentivizing increased transparency and action in developing countries through international regulations and requirements. This could play a role in mitigating vested interests.