Is industry transition now a priority in the latest round of NDCs?.

Key messages

- The latest round of nationally determined contributions (NDCs) will frame the start of a crucial decade in which global emissions need to halve, including those from industry.

- The majority of NDCs include industry in their scope, and almost two-thirds now include detailed industry transition measures, showing progress in the coverage of industry transition.

- However, 6 out of the 15 highest industrial emitters with an updated NDC do not specify any mitigation measures that address industry, while several other high emitters have yet to submit an updated NDC.

- NDCs do not provide the full picture of measures in place and examining and understanding the political context at a national level can provide a better indication of the priority placed on industry transition.

- Nevertheless, NDCs play an important role for policymakers, industry and civil society. The NDC process should be strengthened by identifying barriers to more detailed industry transition measures within NDCs and challenges to their implementation.

Download

Read the brief (pdf)

Background

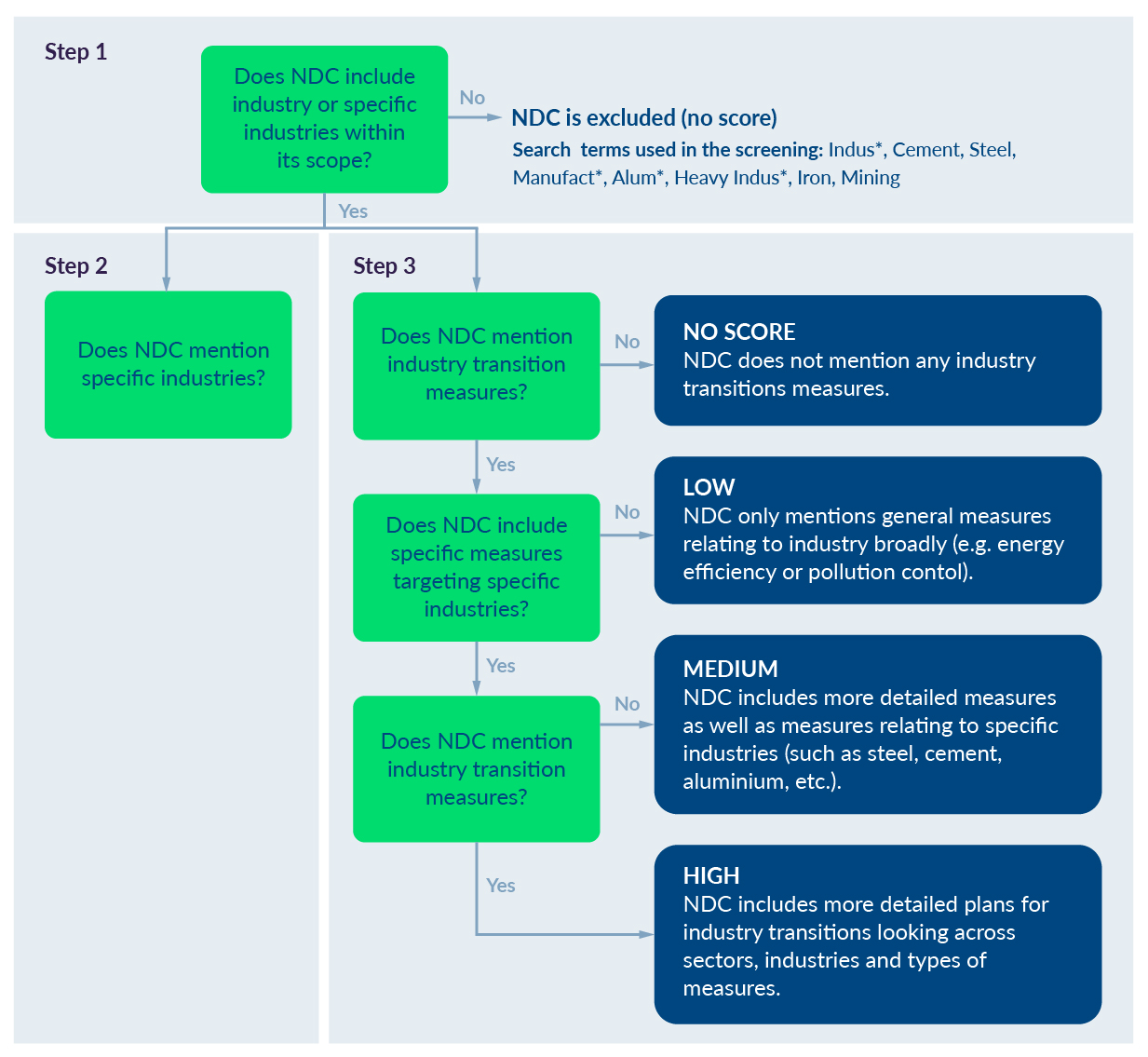

In 2019, the Leadership Group for Industry Transition (LeadIT) Secretariat undertook an assessment of industry transition measures captured in the first round of nationally determined contributions (NDCs) using our NDC Industry Scorecard and analysis method (Figure 1). We found a lack of concrete transition plans.

As parties have been submitting the latest updates to their NDCs in the run-up to COP26, we have taken the opportunity to conduct a second analysis of industry transition measures. Using the same method, we assessed 94 updated NDCs submitted up to 30 September 2021. Our assessment allows us to evaluate the progress made in raising industry transition ambition levels in NDCs and the extent to which parties are proposing detailed decarbonization plans for their heavy industries.

The latest iterations of NDCs will frame the start of a crucial decade for industry transition and climate action. Global emissions need to halve by 2030 and the severe impacts of climate change are increasingly being felt across the world. As the global climate agenda shifts its focus from negotiations to implementation, the commitments in NDCs will play a critical role in sending clear signals of support to industries needing to transform their business models.

The expandable sections take a more detailed look at a comparison of two rounds of NDCs, industry transition measures in NDCs, and some cases from the Global North and South. To find the Annex and full reference list, click on the pdf.

6 out of 15

6 out of the 15 the highest industrial emitters with an updated NDC do not specify any mitigation measures that address industry

The positive overall change seen between the first and second rounds of NDCs

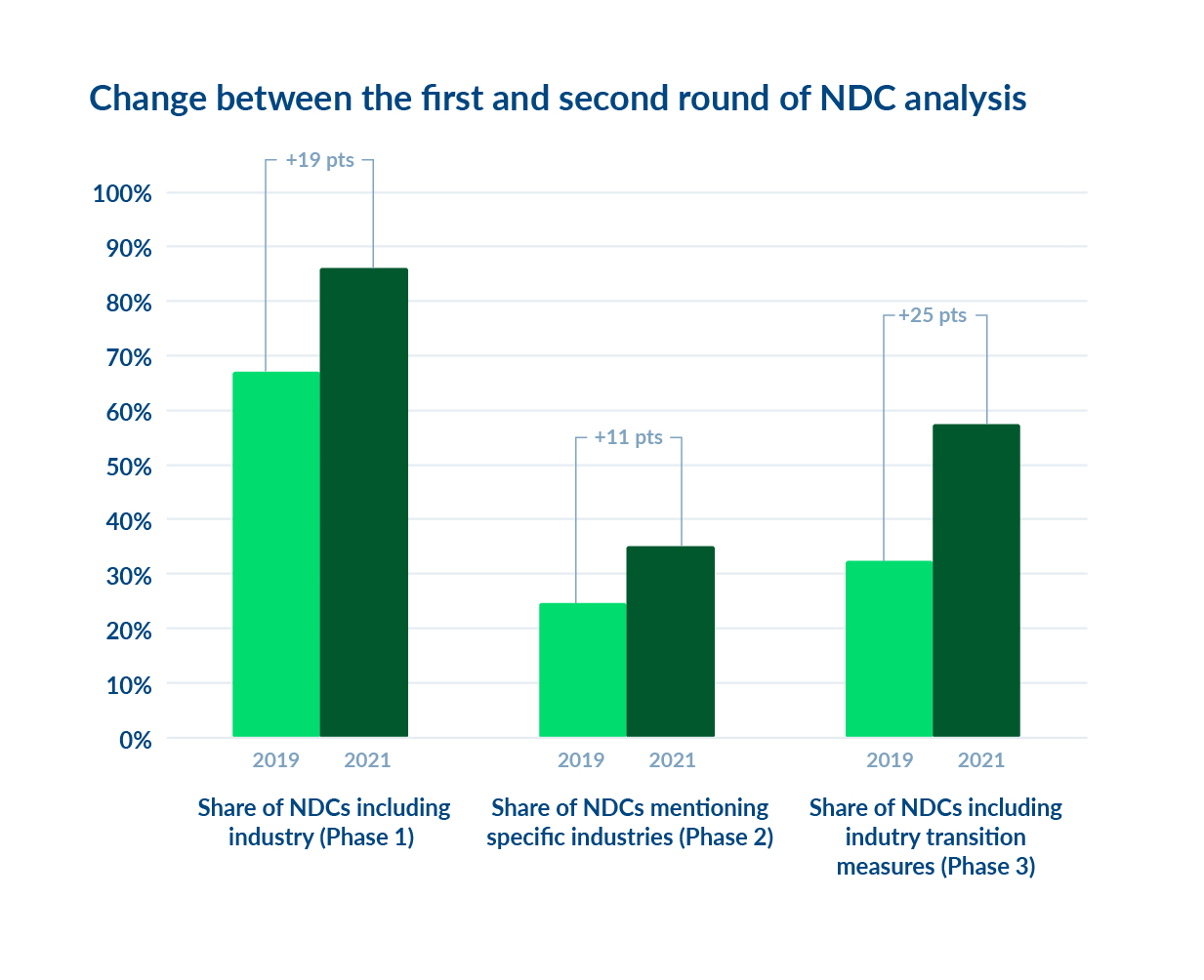

Here, we start by presenting results observed when applying the three-phased Industry Scorecard methodology on the two rounds of NDCs (Figure 2):

- Phase 1 – Industry included in the scope of NDC: 85% of parties that submitted an updated NDC included industry transition in the scope of the NDC, compared to 69% in the first round. About half of the parties that didn’t include industry in their NDCs have negligible emissions from industry, such as small island developing states.

- Phase 2 – Specific industries mentioned in NDC: In the updated round of NDCs, 36% of parties mentioned specific industries such as aluminium or steel, compared to 25% in the first round. In both rounds, the most specified industry sector was the cement industry.

- Phase 3 – Domestic mitigation measures targeting industries included in NDC: 58% of the 94 updated NDCs included domestic mitigation measures targeting emissions from industries, compared to 33% in the first round of NDCs.

Overall, these results show that industry transition is being increasingly included in the scope of NDCs, with improvements evident in all phases of the analysis. This highlights that while industry transition has traditionally attracted little attention, its importance for climate mitigation is becoming increasingly recognized. These findings are in line with those from the UN Climate Change NDC Synthesis Report which found that 39% of parties refer to industry as a specific priority area for domestic mitigation measures. However, the results also show that industry is still most often considered in its aggregated form, with about two-thirds of NDCs not mentioning any specific industrial sector.

An increase in detailed industry transition measures

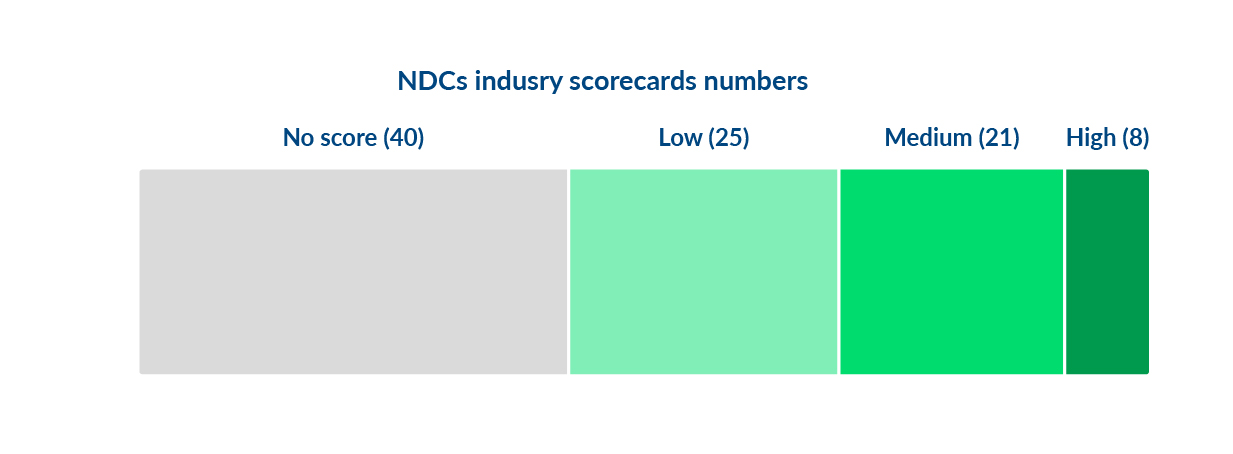

Looking at the level of detail in mitigation measures targeting industry, we found that out of the NDCs that included such measures, 25 (46%) scored low, 21 (39%) scored medium and 8 (15%) scored high (Figure 3). The eight parties that scored high were Guinea, Indonesia, Japan, Malawi, Morocco, Paraguay, Republic of Korea and Rwanda. To illustrate the level of detail found in a high scoring NDC, we have included industry transition measures from Japan’s updated NDC in Annex II.

Looking more closely at high-scoring NDCs, we found that many focus on cross-sectoral measures such as energy efficiency. Concerning sectoral focus, measures targeting cement and iron and steel are covered in half of these NDCs. Another common feature among high-scoring NDCs is the inclusion of timelines and budget estimations for implementing the measures, with Malawi, Paraguay and Rwanda also outlining bodies and stakeholders responsible for a measure’s implementation. Lastly, it is notable that developing countries include measures conditional upon receiving international support as well as unconditional industrial transition measures.

For 86 parties, we were able to compare their scorecard for both rounds of NDCs. We found that one-third of analysed parties went from not having any industry transition measures detailed in their first round NDCs to having either a low (17 parties), medium (11 parties), or high (2 parties) level of detail of specific domestic industry transition measures in their most recent NDC. In addition, five parties that already had industry transition measures detailed in their first NDC improved the level of detail this round.

The significant increase in NDCs containing detailed industry transition mitigation measures shows that NDCs are increasingly being used as a platform to outline policy initiatives, moving beyond stating goals to setting out concrete actions to meet them. NDCs should send clear signals to industries around the world to induce accelerated investments and create long-term support to industries undergoing decarbonization.

A mixed picture among the heaviest industrial emitters

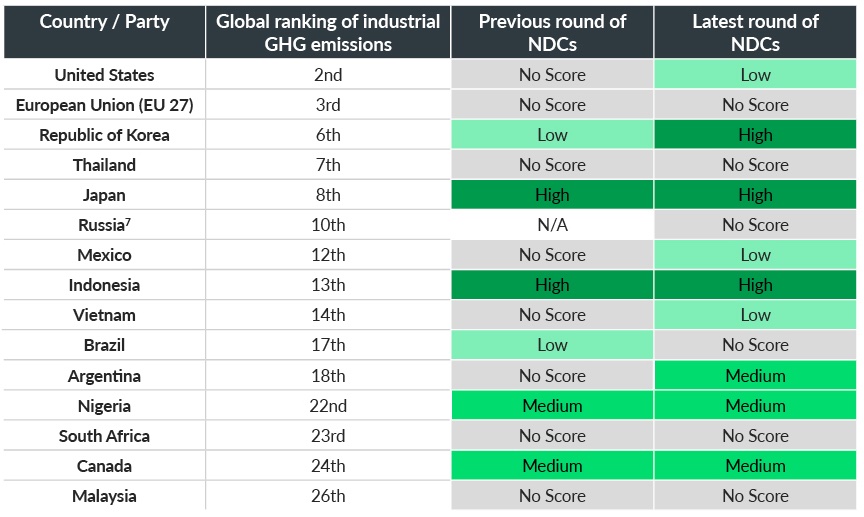

The analysis presented so far has focused on all the parties with an updated NDC, yet the heaviest industrial emitters with updated NDCs account for almost a third of global industrial process greenhouse gas (GHG) emissions. Table 1 focuses on these parties and presents a mixed picture.

On the one hand, it suggests that fewer heavy emitters have omitted industry from the scope of their latest NDCs – 6 out of 15 received ‘no score’ compared to 8 in the first round. In addition, the level of detail on industry transition included in their NDCs has improved in 5 of the 13 cases in which improvements could have been made. The Republic of Korea and Argentina are two of the five countries with considerable improvements in the level of detail on industrial measurements contained in their NDCs.

However, the global ranking of industrial emissions shows the gaps in our analysis. These are a result of pending NDC updates from heavy industrial emitters such as China (ranked 1st), India (4th), Saudi Arabia (5th) and Cameroon (9th). Furthermore, contrary to the spirit of ratcheting up ambition, eight heavy emitters that could have improved their score, did not – with Brazil even removing specific industry measures from its updated NDC. Finally, despite fewer parties with ‘no score’ ratings, these parties still contribute a large proportion of industrial emissions. This raises the question: why are detailed industry transition measures missing from heavy industrial emitters’ NDCs?

NDCs may represent just the tip of the iceberg

To better understand these seemingly missing industry transition measures, we explored three cases from the Global North and South – the European Union, Brazil and Thailand.

The European Union positions itself as a climate leader on the world stage so the lack of industry transition measures in its updated NDC appears puzzling. Although the NDC does make links between industry and its emissions trading system (ETS), there are no explicit references to industries or measures. However, the European Green Deal, the Fit for 55 package and the New Industrial Strategy for Europe provide a raft of measures supporting industry transition, including strengthening the ETS and introducing a Carbon Border Adjustment Mechanism (CBAM), among other sectoral measures. In addition, member states are also introducing national measures for industry transition. These states include Germany, Denmark and France among others.

Brazil is one of the few countries whose NDC has regressed in terms of detailed industry measures. In its first NDC, the extent of industry transition measures was limited to promoting clean technology and enhancing energy efficiency and low carbon infrastructure. There is no reiteration or strengthening of such obligations in the updated NDC. This lack of progress takes place against the backdrop of effectively weakened climate action targets in Brazil’s updated NDC, which reflects the Bolsonaro administration’s opposition to Brazil’s existing climate policy framework. Nevertheless, Brazil has enacted other plans to reduce emissions in other sectors of the economy, including the Steel Industry Plan, the Low Carbon Emission Economy in the Manufacturing Industry Plan and the Low-Carbon Emission Mining Plan.

Thailand is the highest industrial emitting developing country in our analysis and one of the countries that has been most affected by the impacts of climate change. Despite containing no industry transition measures, Thailand’s updated NDC points to several supporting documents, including the NDC Roadmap 2021-2030 and sectoral plans. These documents mention measures and emission reduction targets for energy efficiency and renewable energy in industry, as well as clinker substitution. In addition to highlighting these documents, the NDC includes support needs identified through the development of the NDC. Furthermore, the NDC notes that Thailand is in the process of developing a long-term low GHG emission development strategy (LT-LED) which forms part of the Paris Agreement process and serves to enhance NDCs.

Although these three cases are a small sample, they demonstrate that the absence of industry transition measures in NDCs may represent just the tip of the iceberg. Further investigation into the national political context in which the NDCs are situated could unearth detailed measures and targets. Alternatively, it could reveal a lack of continued political commitment and undermine the process.

Final remarks

Progress to date.

The comparison of the two rounds of NDCs, depicted in Figure 2, shows positive progress in regard to the inclusion of industry in the scope of the NDCs. The analysis also illustrates an increasing level of granularity in NDCs by pointing out specific industrial sectors and detailing mitigation measures targeting industrial emissions. However, despite the increased attention being paid to industry transition for climate change mitigation, progress is too slow. This is extremely problematic considering the rate at which decarbonization needs to happen. The latest report from the Energy Transition Commission, “a global coalition of leaders from across the energy sector landscape committed to achieving net-zero emissions by mid-century”, confirms this finding, stating that current NDCs reflect minimal near-term ambition levels in terms of heavy industry.

LeadIT member countries.

Looking at LeadIT members, we find that Argentina, Ethiopia, the Republic of Korea and the UK significantly improved the level of detail of specific industry transition measures in their NDCs. For example, Ethiopia specifically targets the cement industry with a mitigation measure on clinker replacement, despite industrial sectors accounting for just 2% of its national emissions. Meanwhile, the Republic of Korea focuses on the deployment of technological innovations such as hydrogen reduction in steelmaking. The UK NDC stands out from the crowd with its announcement of a £12 billion investment in the green industrial revolution, which aims to create 250,000 highly skilled green jobs in the UK. Combined with the countries covered by the EU’s raft of policy measures influencing transition, we see that LeadIT members are leading the way in stepping-up ambitions and establishing concrete industry transition measures.

Strengthening NDCs.

Although our sampling of the EU, Brazil and Thailand demonstrated that similar transition measures may be found elsewhere, NDCs can nevertheless serve as a guiding star for national climate policy, facilitate international scrutiny and give assurance to first movers within industry of the direction of the transition. This may be particularly important in countries where a high proportion of national emissions come from industry and there is a lack of comprehensive climate policy frameworks. There is therefore a need to identify the common barriers and challenges faced by parties when providing greater detail on industry transition measures in their NDCs. By doing so, the international community can be better positioned to support and strengthen the NDC process.

Beyond COP26.

Looking ahead, it is worth noting that the latest round of NDC updates, and the next global stocktake due in 2023 which will inform the subsequent round of updates, are only one part of the process of achieving the Paris Agreement’s goals. The ratcheting up of climate ambition must be matched with implementation, as we have now entered the “decade of action”. The success of this ongoing process depends in part on the interfaces between NDCs and national processes and the capacity to ensure their implementation. Indeed, the need for capacity building was identified in the latest NDC Synthesis Report, specifically in terms of formulating policy, integrating mitigation into sectoral planning process, enhancing access to finance and improving data collection. Exploring capacity gaps could shed some light on the disparities between ambition and the implementation of industry transition measures. In this respect, roadmaps are a useful tool for supporting capacity building and spurring industry transition.